Welcome to the Market Summit, your monthly compass in the dynamic world of finance. You and me will delve into the heart of global economic trends, equity and bond market movements, commodity and forex market shifts, and the pulsating rhythm of the cryptocurrency world. Designed for investors, finance enthusiasts, and the informed public, this summit provides a panoramic view of the financial landscape. Join me with navigating the intricate pathways of the July 2023 financial markets. I try to explain as many things as possible but you might not find every explanation given down below. This would go too deep into detail and takes away the attention from the important things. So if you have problems understanding things, please take your time and DYOR. I appreciate you being here and hope you enjoy the effort I put into this detailed market summit.

Global Economic Overview

-World GDP growth: World GDP growth forecast for 2023 is 2,9% according to most sources I checked (e.g. https://www.imf.org/en/Publications/WEO). This is lower than the 2022 estimates. World GDP growth in 2022 is forecasted with 3,3%. Actual data is not available yet, we just have estimates.

The most recent data that is available is from 2021, where the World GDP rose 5,802%. The highest growth rate since 1973. Since GDP growth is measured year over year, we have to factor in that 2020 was the worst performing year in literally decades, with a negative growth rate of -3,271% (Corona-Pandemic).

-Inflation: There is still ongoing concerns about inflation. According to „IMF“ and „The Conference Board“ global headline inflation is to fall from 8,7% in 2022 to 6,8% in 2023 and 5,2% in 2024. In most economies has peaked (e.g. US, Europe, etc.) but core inflation might not have peaked yet and the speed of the disinflationary process is hard to assess. Core inflation is a measure of inflation that excludes certain items that face volatile price movements, notably food and energy.

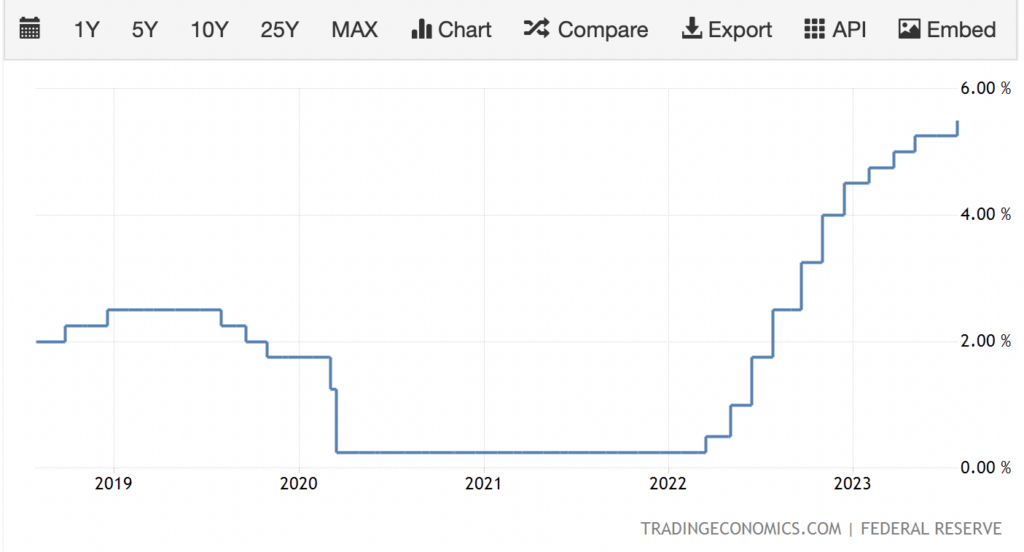

-Monetary policy and financial stability: Essentially monetary policy is the process by which a country’s central bank or monetary authority is managing the money supply and interest rates in order to achieve its policy goals.

The impact of monetary policy tightening on economic activities and financial stability remains crucial around the world, as central banks tried to tackle high inflation numbers. The FED and the ECB both went on its most aggressive period of rate hikes in decades, having notable impact on the economy. The cost of borrowing money went up drastically, having a negative effect on economic growth and activities. The aggressive tightening goes side by side with the risk of a recession, like we already see in Germany for example.

-Risks: According to the IMF the risks of further shocks, including those from an intensification of the war in Ukraine and extreme weather-related events remains high and maybe higher than ever. Further there is a potential risk in financial markets stability. Through the rapid tightening of monetary policy, the bond yields have shot up too quickly, exposing weaknesses in the banking sector and the general financial market. Looking back at the collapse of SVB (Sillicon-Valley-Bank) it might not be a low possibility that „more financial turmoil could be on the horizon“ (https://www.conference-board.org/topics/global-economic-outlook).

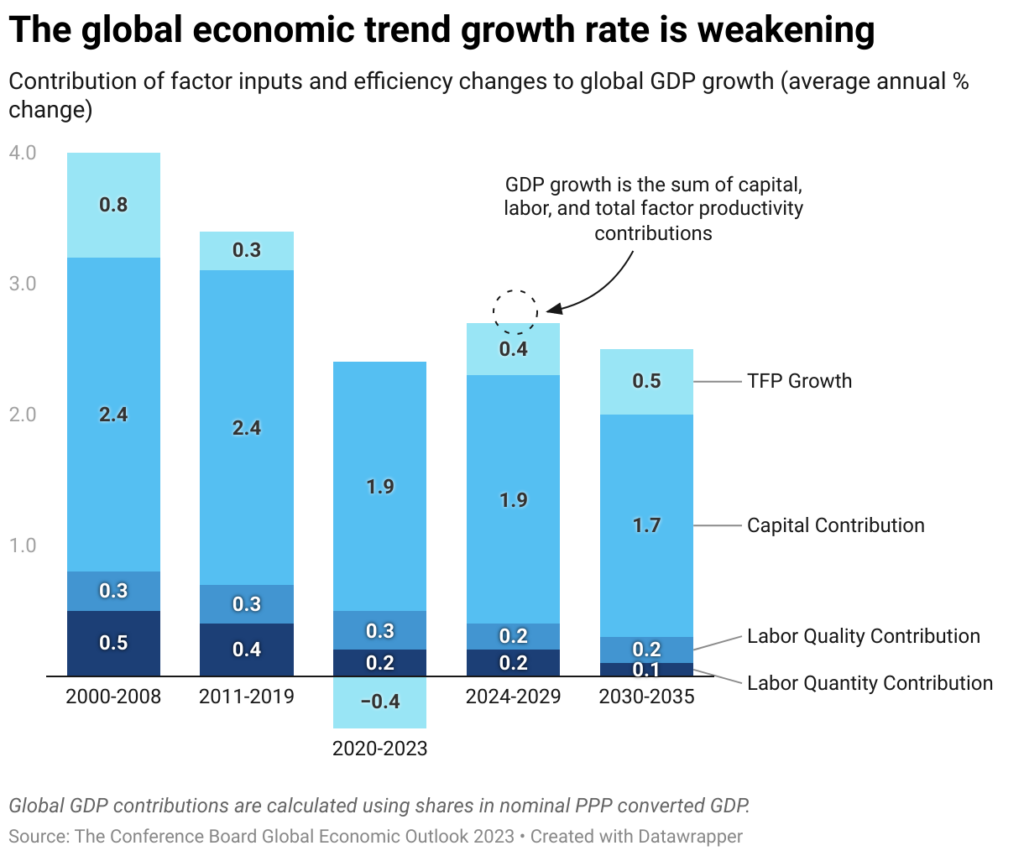

Long-term Outlook: According to most sources I found, the economic outlook shows a modest global GDP growth environment for the next decade. It will be interesting to see how these factors above will adjust over time and how they contribute to a change in the economic outlook and GDP growth rate. For now the economic outlook remains weak.

Equity Markets

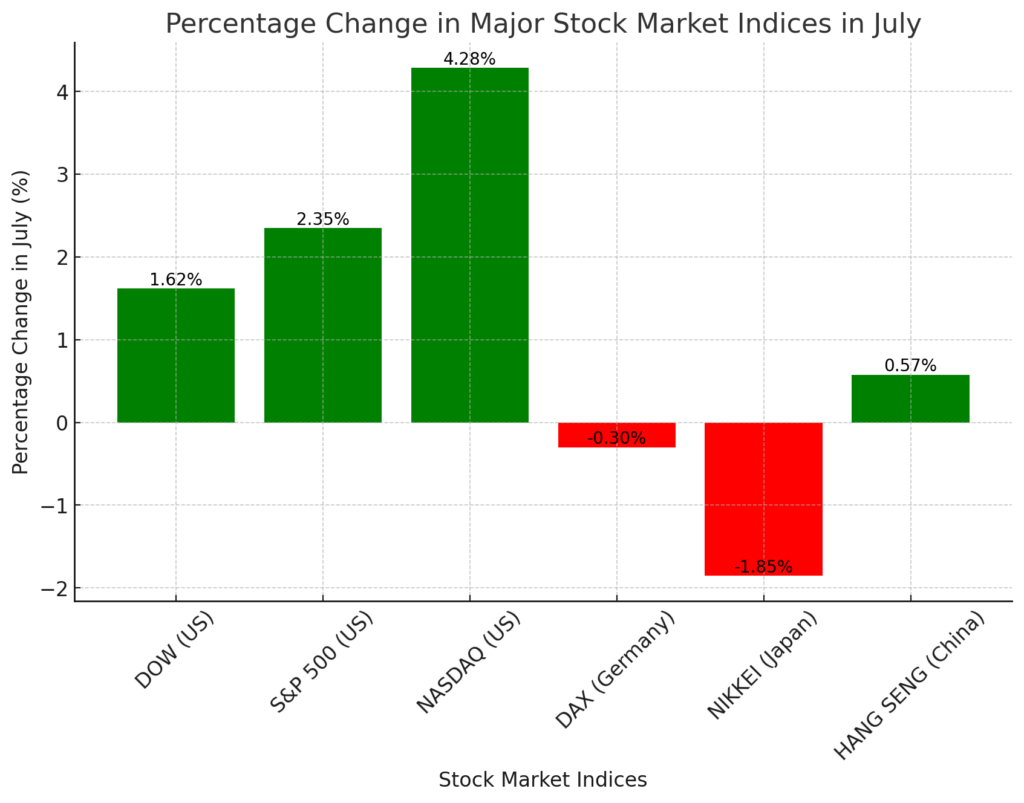

-DOW (US): Open July (34623) —> as the time of writing the DOW is sitting at 35183 which is so far a 1,66% gain in July

-S&P 500 (US): Open July (4450,48) –> as the time of writing the S&P 500 is sitting at 4554,97 which is so far a 2,35% gain in July

-NASDAQ (US): Open July (15190,54) –> as the time of writing the NASDAQ is sitting at 15841,35 which is so far a 4,36% gain in July

-DAX (Germany): Open July (16187,91) —> as the time of writing the DAX is sitting at 16139,39 which is so far a 0,05% loss in July

-NIKKEI (Japan): Open July (33517,6) —> as the time of writing the NIKKEI 225 is sitting at 32895,96 which is so far a 0,88% loss in July

-HANG SENG (China): Open July (18825) —> as the time of writing the HSI is sitting at 18933 which is so far a 0,68% gain in July

S&P 500 and NASDAQ continue to outperform other indices. There is a high demand for technology stocks, where especially AI is leading the way. NVIDIA continues its rally and is now sitting at a decent 4,3x (as per time of writing) since the lows around 110 $/share in October 2022. But not just NVIDIA continues the strong performance. Also Tesla gains another 12,06% and maintains the great performance year to date. Chinese technology stocks are still underperforming, following the weak performance of the Hang Seng, even though being traded on the NASDAQ.

Overall the market seems to be willing to take more risk. That’s certainly due to the FEDs actions (see „fixed income markets“).

Fixed Income Markets

Bonds explained: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When buying a bond the person buying it, is essentially lending money to the issuer for a specific period. In return, the issuer pays a periodic interest at a fixed or variable rate, and at the end of the bond’s term, you receive the initial principal amount back.

-10year Bond: The 10year US bond provides an annual yield of 3,889%.

-5year Bond: The 5year US bond provides an annual yield of 4,139%.

-2year Bond: The 2year US bond provides an annual yield of 4,856%.

-US-Dollar-Index: For context: The DXY, or US Dollar Index, is a measure of the value of the United States dollar relative to a basket of foreign currencies. The DXY is often used as a barometer for the overall health of the US economy and is watched closely by economists, traders, and investors around the world.

After peeking out at 114 points on the 29th of September, the US dollar Index has steadily declined. July lows have been around 99points. The sharp decline is due to „signs of disinflation in the US and the expectation that the Federal Reserve is nearing the end of its interest rate hiking cycle“ according to „Reuters“(https://www.reuters.com/markets/currencies/dollar-takes-beating-traders-see-us-rates-peaking-2023-07-13/).

-Monetary policy: The market already had priced in a 25 basis point hike by the federal reserve (FED). On July the 27th the FED approved this 25 basis point rate hike, „taking the benchmark for borrowing costs to their highest level in more than 22 years,“ according to CNBC. FED funds rate is now sitting at 5.25%-5.5%.

The market is anticipating this to be the last hike in 2023. Anyhow, Chairman Jerome Powell said its possible that rates could be raised again, depending on the incoming data, like inflation numbers, job reports, and economic activity.

-Inflation: According to Jerome Powell inflation has moderated somewhat, but is still quiet far of from the FEDs 2% target. The consumer price index (CPI) rose 3% on a 12-month basis in June, after running at a 9,1% rate a year ago.

-Labor Market: Employment showed stronger signs than expected. Unemployment rate in June has been 3,6%, which is about 6million people in absolute numbers.

Commodity Markets

-Gold: (+2,16%) Gold slightly up month over month. Still Gold continues to stay sub 2000$/OZ. A monthly close above 2000$ could send the gold price potentially higher.

-Silver: (+8,02%) Silver with a solid 8,02% profit on the month. Silver moves more volatile compared to gold. Since the local highs in August 2020 Silver is more or less trading in a range (21,8$/OZ – 26,3$/OZ). With a potential breakout from this range silver prices might get back to around 30$, where the next resistance is waiting.

-Oil: WTI Crude Price (79,46$), Brent Crude (83,50$), up around 12,8% on the month

-Energy: Global energy prices peaked in august last year at around 376 per unit. May 2023 shows around 169 per unit, a significant lower price.

Foreign Exchange Markets

-USD/EUR: The Euro fell below par value against the USD in summer 2022, the first time in two decades. Ever since the Euro has steadily gained back value against the USD, now sitting at 0,8986 USD/EUR. According to Rob Haworth from the „U.S. Bank“ the Federal Reserve’s decisions to raise the federal funds rate quickly, bond yields in general moved higher in the U.S. than in Europe, and even more so when considering inflation. He mentions that more attractive real yields tended to draw more foreign investment dollars, improving the demand for dollars and driving its value higher. Further the economic outlook for Europe was another contributing factor, as the risk of a recession looked even worse than in America.

-USD/YEN: The Japanese Yen is continuing its upward trend for another month in a row. The Yen bottomed around mid January 2023 at 127 Yen/US-Dollar after being down 18% against the USD in 2022. According to „Bloomberg“ investors are diversifying their portfolios, pinning more hopes on the Yen. Higher odds of major economies crashing because „central banks are forced to keep tightening amid stickier-than expected-inflation“(https://www.bloomberg.com/news/articles/2023-07-11/timing-the-global-recession-is-now-key-for-battered-yen-bulls) are making investors rotate more funds into the Yen, as it has been kind of a safe haven historically during these conditions.

-USD/GBP: In October 2022 the British pound tested a resistance not met since 1985 around 1,05 GBP/USD. Ever since it has recovered quiet some to 1,2851 GBP/USD. One of the factors for the sharp decline was extraordinary high inflation in Great Britain. The inflation there seems to be stickier compared to other economical strong nations, still sitting at 7,9%. According to Capital.com „the cost-of-living crisis taking hold, growth slowing, and debt markets in disarray following the latest budget, the outlook for the pound continues to deteriorate“(https://capital.com/gbp-to-usd-forecast-what-is-next-for-the-forex-pair).

Crypto Currency Market

Bitcoin

BTC: The price per Bitcoin is 29457$ as the time of writing. This marks a 3,32% loss on the month of July. Still this marks an almost 100% gain for Bitcoin since the Dec. 2022 lows.

BTC-Dominance: Bitcoin-Dominance is sitting at 49,79% as the time of writing. The Bitcoin-Dominance shows how much of the overall Crypto Market Cap (MC) is consumed by Bitcoins MC. Hitting a low in September 2022 at around 39%, the Bitcoin has gained some strength against the rest of the crypto market, meaning BTC has performed better than the average crypto currency existing. Anyway, for now the BTC-Dominance seems to not break the critical 50%.

BTC-Market Cap: Bitcoins Market Cap is $573.092.297,42

Alternative Coins (ALTS), Focus on ETH

-Total Crypto Market Cap: All crypto currencies together are worth 1.19 Trillion USD, which is less than some investment funds have assets under management.

ETH/USD: The price of Ethereum is sitting at 1879,24$ as the time of writing.

ETH/BTC: As the time of writing one Ethereum is worth 0.063449 Bitcoins. Ethereum is having a positive performance on the month against BTC. Anyway Ethereum is trading in a range since may 2021. The range goes from 0.055494 ETH/BTC up to 0.078454 ETH/BTC. Without breaking this range to the upside or downside, we won’t see any major price action on this pair.

SOL/USD: As the time of writing Solana is trading at 25,33 USD per coin, significantly down from its top in Nov 2021. Down around 90%.

XRP/USD: Ripple is an interesting case. Recently Ripple one a court case and is not declared a security. This is essential, not only for XRP but also for the Alt-Coins on the crypto market. After the crackdown by the SEC on alternative coins, claiming all of them are securities, this is a major step in the right direction for crypto at a whole but specifically crypto regulations.

XRP is trading at 0.7171 as the time of writing. That’s a 51,7% gain in July alone. Its going to be interesting to see if the price of ripple continues its upward trend and if the company itself is now concentrating on actually making revenue, instead of having to fight a lawsuit.

-Meme coins: The meme coin frenzy has cooled down, since PEPE has hit a peak MC of over 1 billion USD.

DOGE/USD: Elons favorite crypto currency is having a very good monthly performance. In numbers this accounts for 20,39% gain as the time of writing.

SHIB/USD: Very low volume, almost no movement. Traders are on other coins. Shiba Inu with a 4,5% gain on the month of July is more like a stable coin, rather than a meme coin.

PEPE/USD: 13,83% loss on the month. The Pepe hype from earlier this year cooled off. Tho it might have been just the first phase of euphoria. Possibly tapping into a bull run in the beginning of 2024, PEPE could thrive to new highs.

-NFTs: Non-fungible-tokens are still quiet dead and we don’t see funds rotating into this sector anytime soon. Things will probably stay very illiquid for a while and it won’t be fun trading. If you want to get into NFTs look for these who actually having a product and generating revenue. Also you can look for fine art. For example „Themes and Variations by Vera Monlár“ was launching on July the 26th and is selling like hot cake. First secondary sales where around 1ETH. Prices as time of writing are 3.4ETH, which is a 3,4X.

-Ordinals: The new hype on the Block(chain).

100.000.000 sats (Satoshi) is equivalent to 1 BTC. With the implementation of the new ordinals protocol people operating bitcoin nodes can now inscribe data onto each individual sat. This is then called an “Ordinal”. A lot of people have started to inscribe digital art onto the sats, written and animated text messages, poetries and more. Another interesting factor about ordinals is the rarity of each individual sat. A sat from the first ever mined block for example is more rare than the average mined sat from 2014. Since there is different rarities in sats, it is quiet obvious that some sats are valued more than other sats, creating a kind of gold rush in the early days, which is called “Sat Hunting”. Individuals would try to find as many rare or historic sats as possible. Even “Pizza Sats” had their own little craze.

*Funny side note: Pizza sats are Satoshi that have been used to order pizza in the early days of bitcoin, when people didn’t believe in its possible future value.*

If you enjoyed this market summit, I hope to have you back next month for the “Market summit – August, 2023”, as we take another deep dive into the current state of the market. Until then enjoy other articles that myself or co-authors post on this blog.

Thanks for reading! Sincerely,

Lych

References

-https://www.oecd.org/economic-outlook/june-2023/

-https://www.worldbank.org/en/publication/global-economic-prospects

-https://www.imf.org/en/Publications/WEO

-https://www.bloomberg.com/markets

-https://de.tradingview.com

-https://home.treasury.gov/policy-issues/financing-the-government/interest-rate-statistics

-https://www.investing.com/rates-bonds/

-https://markets.ft.com/data/bonds

-https://oilprice.com

-https://www.worldbank.org/en/research/commodity-markets

-https://www.investing.com/commodities/

-https://www.xe.com/currencycharts/

-https://www.forexfactory.com

-https://coinmarketcap.com

-https://www.coingecko.com

-https://cointelegraph.com

Disclaimer: Non of the above is actual financial advise and should not be considered as such. I don’t take responsibility for the correctness of information stated, even though I have done my proper due diligence.